MAVENS’ Planet your sourcing partner in India guides all his vendors and buyers steps for importing goods from India.

Import means bring (goods or services) into a country from abroad for sale.

The buyer of such goods and services is referred to an importer who is based in the country of import whereas the overseas based seller is referred to as an exporter.

Thus an import is any good (e.g.garments) or service brought in from one country to another country in a legitimate fashion, typically for use in trade

Direct Import

Direct-import refers to a type of business importation involving a major retailer (e.g. Wal- Mart) and an overseas manufacturer. A retailer typically purchases products designed by local companies that can be manufactured overseas.

Indirect Import

In a direct-import program, the retailer bypasses the local supplier (colloquial middle-man) and buys the final product directly from the manufacturer, possibly saving in added costs. This type of business is fairly recent and follows the trends of the global economy.

If company importing goods from India for first time, it has to check whether the item is allowed or not( using RED(BLUE) Book).

Get list of local manufacturers and Ask for Quotations from them.

If local manufacturers are unable to supply get a written statement from them.

Submit the statement to Government to get Clearance for Import.

Government will might suggest names of suppliers or could write themselves to suppliers and clear the item for Import.

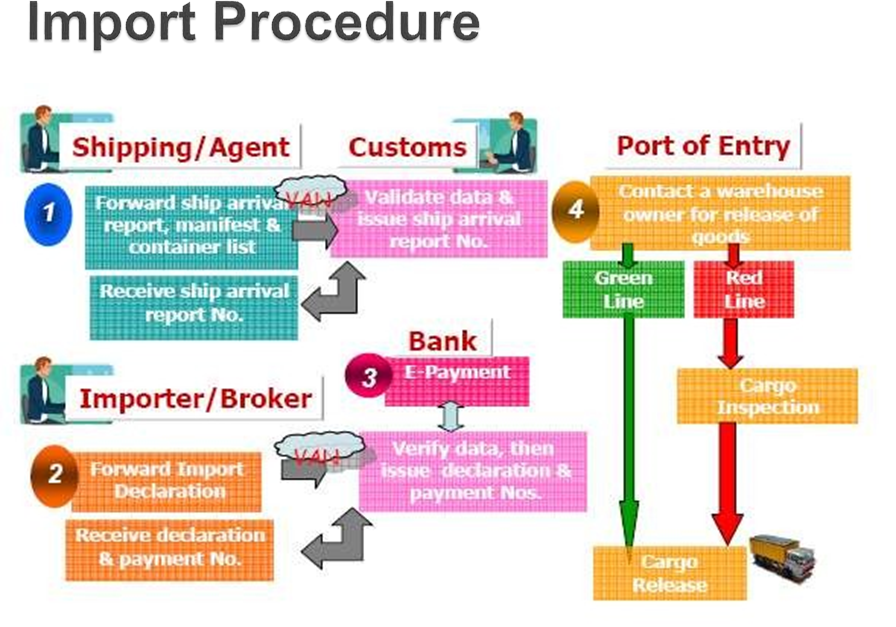

After Import Clearance is obtained a company has to go through following stages:-

- Locating Foreign Source of Supply

- Procurement of the item

- Documentation

Documents Required For IMPORTING GOODS FROM INDIA :-

1.Bill of Lading / Airway bill :

Bill of lading under sea shipment or Airway bill under air shipment is carrier’s document required to be submitted with customs for import customs clearance

purpose. Bill of lading or Airway bill issued by carrier provides the details of cargo with terms of delivery.

2.Invoice: Invoice is required for import customs clearance for value appraisal by concerned customs official. Assessable value is calculated on the basis of terms of delivery of goods mentioned in commercial invoice. The concerned officer verifies the value mentioned in commercial invoice matches with the actual market value of same goods. This method of inspection by officer of customs prevents fraudulent activities of importer or exporter by over invoicing or under invoicing

3.Bill of Entry:

Bill of entry is one of the major import document for import customs clearance. As explained previously, Bill of Entry is the legal document to be filed by CHA or Importer duly signed. Bill of Entry is one of the indicators of ‘total outward remittance of country’ regulated by Reserve Bank and Customs department. Bill of entry must be filed within thirty days of arrival of goods at a customs location.

4.Import License

Import license may be required as one of the documents for import customs clearance procedures and formalities under specific products. This license may be mandatory for importing specific goods as per guide lines provided by government. Import of such specific products may have been being regulated by government time to time. So government insist an import license as one of the documents required for import customs clearance to bring those materials from foreign countries.

5.Insurance certificate

Insurance certificate is a supporting document against importer’s declaration on terms of delivery.

Insurance certificate under import shipment helps

customs authorities to verify, whether selling price includes insurance or not. This is required to find assessable value which determines import duty amount.

6.Purchase order/Letter of Credit

A purchase order reflects almost all terms and conditions of sale contract which enables the customs official to confirm on value assessment. If an import consignment is under letter of credit basis, the importer can submit a copy of Letter of Credit along with the documents for import clearance.

7.Industrial License if any

An industrial license copy may be required under specific goods importing. If Importer claims any import benefit as per guidelines of government, such Industrial License can be produced to avail the benefit. In such case, Industrial license copy can be submitted with customs authorities as one of the import clearance documents.

8.DEEC/DEPB /ECGC or any other documents for duty benefits If importer avails any duty exemptions against imported

goods under different schemes like DEEC/DEPB/ECGC etc., such license is produced along with other import clearance documents.

9.Central excise document if any

If importer avails any central excise benefit under importing goods from India, the documents pertaining to the same need to be produced along with other import customs clearance documents

10.GATT/DGFT declaration.

As per the guidelines of Government of India, every importer needs to file GATT declaration and DGFT declaration along with other import customs clearance documents with customs. GATT declaration has to be filed by Importer as per the terms of General Agreement on Tariff and Trade.

The Government of India has been taking various steps towards boosting its trade and we as India’s trusted buying agency assists our buyers in importing goods from India at every step.

.